Largest Grocery Retail Markets in Europe

The European grocery retail market is one of the largest and most diverse in the world, driven by a complex mix of local traditions, changing consumer expectations, and rapid technological advancements. As home to over 500 million people, Europe offers a highly fragmented and competitive grocery landscape where multinational giants and local chains compete to meet the evolving needs of customers. From bustling hypermarkets to small neighborhood stores and rapidly expanding e-commerce platforms, the European market has shown remarkable adaptability, balancing tradition with innovation.

While consumer preferences vary significantly across the continent, certain trends are shaping the grocery sector as a whole. The demand for convenience is growing, with a surge in online grocery shopping and a preference for smaller, local stores over traditional large-format supermarkets. Sustainability has also become a major factor, as environmentally conscious consumers look for retailers that prioritize eco-friendly practices, waste reduction, and ethically sourced products. Additionally, health and wellness are becoming more important, with a rising demand for organic and health-focused items, further diversifying the offerings of grocery retailers.

As Europe’s grocery sector continues to transform, it is the largest markets that drive many of these changes. Here, we take a closer look at the top ten grocery retail markets in Europe, with a special focus on the five largest players, whose influence extends well beyond their national borders.

Europe’s grocery market size

The European grocery market is one of the largest globally, valued at approximately €2.3 trillion, accounting for nearly 25% of the worldwide grocery retail market. This places Europe alongside North America and Asia as one of the three biggest grocery markets in the world. Comparatively, the North American grocery market is estimated at around €1.5 trillion, comprising roughly 16% of the global market. Asia, with its vast population and growing economies, leads in total market size, valued at about €2.8 trillion, or 30% of the global market. Europe’s diverse consumer base and high per-capita spending make it a unique landscape for grocery retail, with countries like Germany, the UK, and France contributing significantly to the continent’s total grocery market share.

The Largest Grocery Retail Markets in Europe: Top 10 Overview

Europe’s grocery retail industry is highly diverse, catering to a vast population with varying tastes, cultural preferences, and spending habits. The largest markets have evolved rapidly, embracing new technology, sustainability, and convenience to meet consumer demands. Below, we explore the top 10 largest grocery retail markets in Europe, with a deeper dive into the five biggest players that shape the European grocery landscape.

Top 10 Grocery Retail Markets in Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Poland

- Belgium

- Sweden

- Switzerland

Germany: Europe’s Grocery Powerhouse

Germany boasts Europe’s largest grocery retail market, primarily dominated by national giants Edeka, Rewe, Aldi, and Lidl. Known for its price-conscious consumers, the German market emphasizes value without compromising on quality. Discount stores have traditionally thrived here, with Aldi and Lidl pioneering the “discount culture” that’s now internationally recognized. Recently, however, consumer preferences are shifting. Germans are increasingly valuing organic and sustainable products, which has led traditional and discount supermarkets alike to expand their organic offerings. Digitalization is also accelerating; many retailers now offer online shopping and home delivery services to cater to the growing demand for convenience.

United Kingdom: Pioneering E-commerce in Groceries

The UK is one of the most advanced grocery e-commerce markets in Europe, driven by major players like Tesco, Sainsbury’s, Asda, and Morrisons. With a highly competitive landscape, British retailers have had to innovate, especially post-Brexit, which affected supply chains. The rise of online grocery shopping, accelerated by the pandemic, has led retailers to improve their digital capabilities, from same-day deliveries to “click and collect” services. There is also a strong focus on private-label products, with retailers investing heavily in premium store brands to attract a broad customer base. Sustainability remains high on the agenda, with companies striving to reduce plastic waste and embrace more eco-friendly packaging.

France: Quality, Diversity, and Sustainability

In France, consumers place high value on food quality, regional specialties, and fresh produce, and this is reflected in the retail strategies of major players like Carrefour, E.Leclerc, and Auchan. French grocery retail is highly fragmented, with hypermarkets being especially popular. However, the recent trend is a shift toward smaller, local stores to meet the increasing demand for convenience. Sustainability is a major focus, with stores reducing waste and emphasizing local sourcing. For example, Carrefour is investing heavily in organic and eco-labeled products and was among the first to embrace “zero-waste” aisles. Digital transformation is also ongoing, with Carrefour’s continued expansion of its online platform to better compete with e-commerce platforms.

Italy: Regional Preference Meets Rapid Modernization

Italy’s grocery market is marked by a strong presence of local and cooperative brands like Coop Italia, Conad, and Esselunga. Italian consumers prefer fresh, high-quality products, often from local sources, and supermarkets cater to this demand by emphasizing local produce. While Italy has traditionally lagged behind in e-commerce adoption, this is changing rapidly. Post-pandemic, Italian retailers have ramped up their digital offerings, with many grocery stores now offering home delivery and online shopping options. There is also a growing demand for organic and health-conscious products, with Italian retailers expanding their selections of organic and specialty health foods to cater to these new consumer trends.

Spain: Dominance of Local Chains and Innovative Private Labels

Spain’s grocery market is notable for the dominance of local chains like Mercadona, which controls a significant share of the market. Mercadona’s business model, focused on private-label products, has been particularly successful, with a wide range of quality private-label items across various price points. Carrefour and Dia also have significant shares of the market, but competition is intense. Spanish consumers are value-oriented yet increasingly interested in premium and organic options, which has led retailers to diversify their product offerings. The demand for convenience is driving innovation, with many retailers now offering online shopping, home delivery, and same-day delivery services. Sustainability initiatives, particularly in reducing food waste, are also gaining traction.

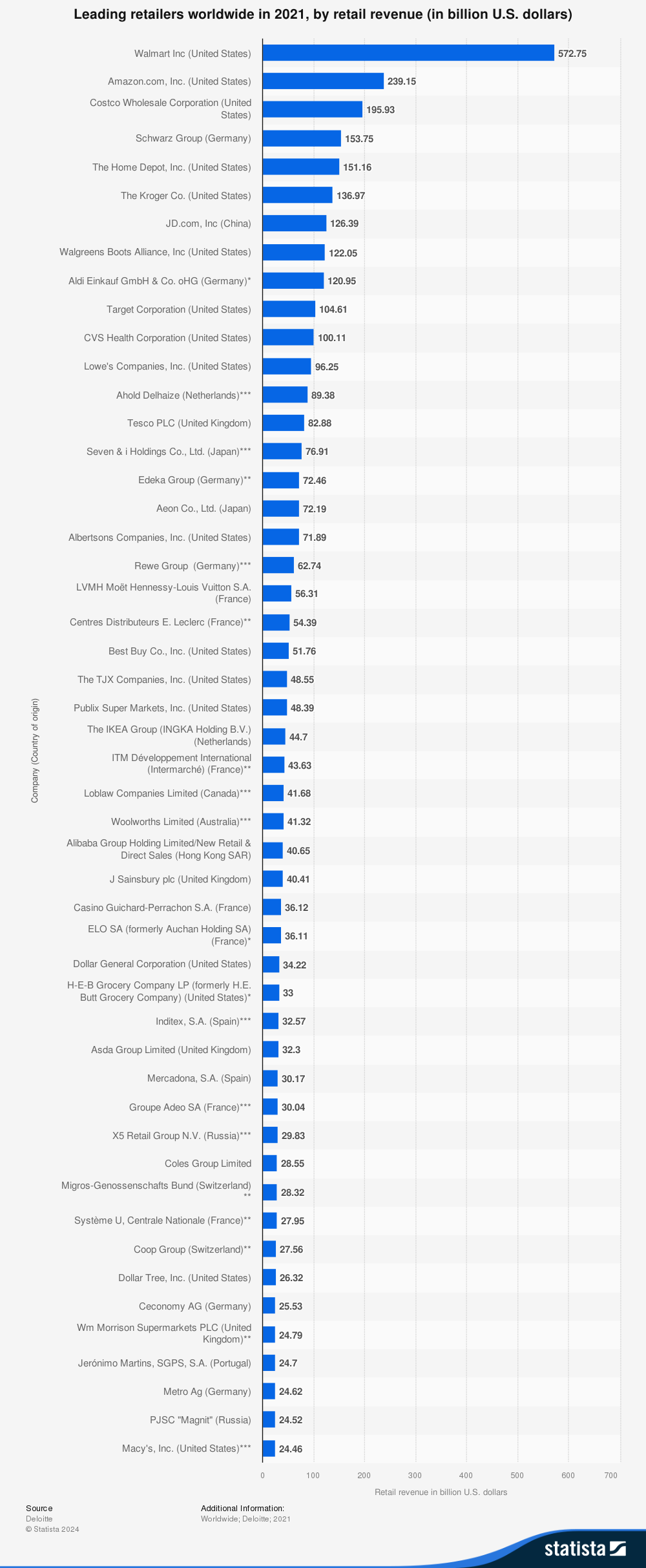

Preview: What are the largest retailers worldwide?

The Role of E-commerce, Sustainability, and Innovation

Across Europe, the grocery retail sector is undergoing a digital transformation as retailers embrace e-commerce to meet the evolving needs of consumers. Sustainability is another unifying trend, with companies prioritizing eco-friendly initiatives, from reducing plastic use to promoting locally sourced products. The importance of private-label products continues to rise, as retailers in Europe strive to provide quality, affordable alternatives to national brands.

Each country in Europe’s grocery retail market has its own unique traits, shaped by consumer preferences, economic conditions, and cultural factors. As these markets continue to evolve, we can expect to see further innovation in response to consumer demand for convenience, quality, and sustainability.