Rise of Mobile Wallets in the Retail Experience

In today’s fast-paced digital world, the convenience of mobile wallets is transforming the retail experience, particularly in the grocery sector. More than just a payment method, mobile wallets are becoming a central hub for enhancing the consumer shopping journey with integrated loyalty programs, discounts, and personalized offers. This integration offers a seamless and enriched shopping experience that is rapidly gaining traction among consumers.

Convenience at Your Fingertips

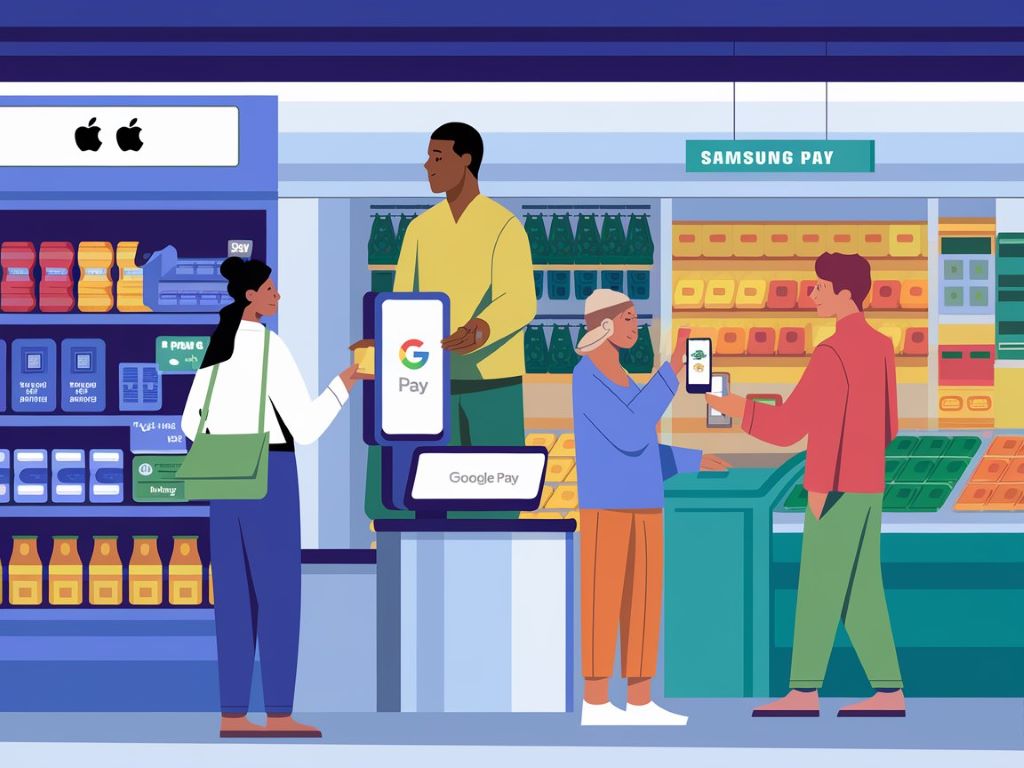

Mobile wallets such as Apple Pay, Google Wallet, and Samsung Pay allow consumers to store their payment information securely on their smartphones. But the utility of these wallets extends far beyond simply substituting a physical wallet. In an era where efficiency and speed are paramount, the ability to conduct transactions swiftly at checkout points is highly valued. Mobile wallets answer this demand with their contactless payment technology, enabling users to make payments in a matter of seconds.

Popular Mobile Wallets Across Europe

In Germany, mobile payment solutions such as Google Pay and Apple Pay are widely accepted, alongside local favorites like Sparkasse’s “Mobiles Bezahlen” app, which is popular among German Sparkasse bank customers.

In France, besides international giants like Apple Pay and Google Pay, Lydia is a popular choice, offering a mobile payment system widely used across the country for its ease of splitting bills and transferring money among friends.

In the UK, Apple Pay and Google Pay also dominate the market, but there are also widely used platforms like the Barclays Mobile Banking app that offer integrated wallet functionalities which include direct debit and credit management.

Beyond Payments: Loyalty and Personalization

One of the most significant advantages of mobile wallets is their ability to integrate various loyalty programs. Consumers no longer need to carry multiple loyalty cards or remember to present them during transactions. Instead, everything is stored digitally and automatically applied when making a purchase through the mobile wallet. This not only streamlines the process but also ensures that consumers are more likely to use their loyalty benefits, increasing customer satisfaction and retention.

Additionally, mobile wallets can store digital coupons and automatically apply them at the point of sale, ensuring that consumers get the best deals without the hassle of clipping physical coupons. This integration can be particularly beneficial during promotions, allowing consumers to save money effortlessly.

Tailored Shopping Experiences

With the wealth of data collected, mobile wallets can offer highly personalized shopping experiences. Based on purchasing history, mobile wallets can suggest products, predict shopping needs, and even alert consumers to deals on their favorite products. This level of personalization not only enhances the shopping experience but also fosters a stronger bond between retailers and consumers.

Security and Privacy

Amidst these benefits, mobile wallets also offer robust security features. Advanced encryption and tokenization methods ensure that consumer payment information is securely stored and transmitted. Furthermore, most mobile wallets require authentication (such as a fingerprint or a PIN) to access, providing an additional layer of security compared to traditional payment methods.

Case Study: Integration of Consumer Apps and Digital Coupons

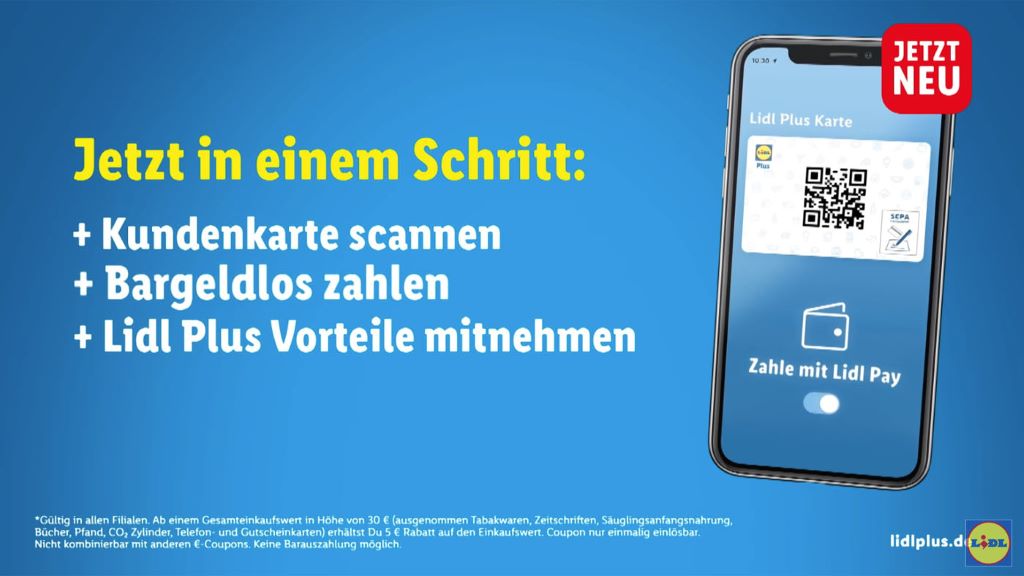

As mobile wallets continue to reshape the payment landscape in European grocery retail, another critical evolution is seen in the integration of consumer apps and digital coupons. This convergence enhances the overall shopping experience, providing more than just transactional benefits. Retail apps such as those offered by Lidl and Rossmann in Germany exemplify this trend by merging the convenience of mobile payments with the advantages of personalized shopping.

Lidl’s Mobile App offers a seamless integration of its loyalty programs with mobile wallets, allowing customers to not only make payments but also to access digital coupons and special offers directly from their smartphones. This functionality not only speeds up the checkout process but also tailors the shopping experience to individual preferences and buying habits, thereby increasing customer satisfaction and loyalty.

Rossmann’s App similarly leverages technology to enhance consumer interaction. The app provides users with exclusive digital coupons and promotional offers that can be easily redeemed at checkout via mobile wallets. This integration ensures that customers enjoy a streamlined and cost-effective shopping experience, encouraging frequent use and engagement with the app.

These apps epitomize how digital tools are being employed to bridge the gap between online convenience and in-store shopping, offering a hybrid model that meets modern consumer demands. As more retailers adopt such integrated solutions, the line between digital payment systems and loyalty platforms continues to blur, creating a more interconnected and dynamic retail environment.

The Future is Now

As more retailers and consumers adopt mobile wallets, we can expect these platforms to become even more integrated into the shopping experience. Future enhancements may include even more advanced personalization, greater integration with online shopping platforms, and expanded loyalty options.

The integration of mobile wallets is more than just a trend; it’s a shift towards a more connected and personalized consumer experience. Retailers who leverage this technology can enhance their customer service, streamline operations, and secure a competitive edge in the fast-evolving retail landscape.